Introduction: The Power of Financial Services Insights

In the dynamic realm of finance, staying ahead means staying informed. That’s where FSI Blogs US comes in—a curated universe of insights, strategies, and forward-thinking analysis from within the financial services industry (FSI) in the United States. These blogs are not mere digital journals—they’re pulse readers of an ever-transforming financial landscape.

This article serves as a comprehensive resource to explore FSI blogs, unpacking their value, types, influencers behind them, and how businesses, consumers, and professionals can leverage this knowledge ecosystem. From fintech to regulations, investment strategies to blockchain applications, the FSI Blogs US scene is where foresight meets function.

What Are FSI Blogs US?

FSI Blogs US refers to financial services blogs that originate from or focus on the United States market. These blogs span a range of verticals, including:

- Banking and financial regulation

- Fintech innovations

- Investment and wealth management

- Compliance and cybersecurity

- Blockchain and digital currency

- Risk management and analytics

But more than just being topical, FSI blogs are influential. They play a key role in shaping discussions, informing policy, and guiding business decisions across the American financial ecosystem.

The Evolution of Financial Services Content

The landscape of financial services innovation has undergone a remarkable transformation over the past decade. Traditional banking institutions, once the sole gatekeepers of financial wisdom, now share the stage with digital-first platforms, independent analysts, and technology-driven thought leaders. This democratization of financial knowledge has created an environment where FSI Blogs US serve as critical bridges between complex industry developments and practical application.

The United States, as a global financial hub, generates unprecedented volumes of regulatory changes, technological breakthroughs, and market shifts. Financial services blogs have emerged as essential navigational tools, helping stakeholders make sense of this complexity. They translate regulatory jargon into actionable intelligence, break down technological innovations into understandable concepts, and provide real-time commentary on market movements that impact everything from individual investment portfolios to enterprise-level strategic decisions.

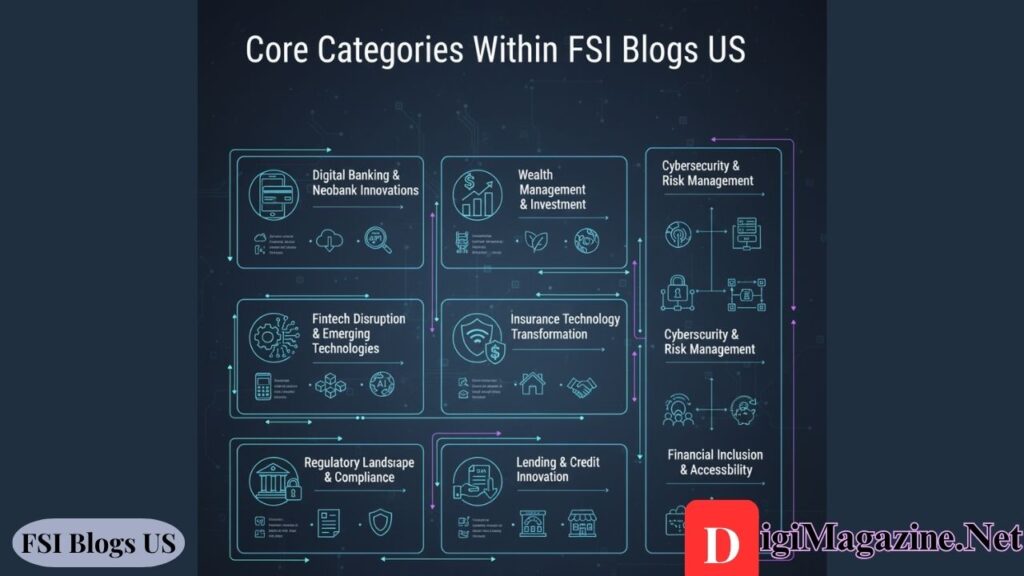

Core Categories Within FSI Blogs US

Digital Banking and Neobank Innovations

The rise of digital banking has revolutionized how Americans interact with their finances. FSI Blogs US extensively covers the neobank revolution, exploring how challenger banks are reshaping customer expectations around convenience, transparency, and personalization. These blogs examine the competitive dynamics between traditional financial institutions and digital-native platforms, offering insights into mobile banking trends, user experience innovations, and the technology infrastructure enabling seamless financial transactions.

Content in this category often explores open banking frameworks, API ecosystems that allow third-party developers to build applications around financial institutions, and the emergence of super apps that consolidate multiple financial services into a single platform. Readers gain perspectives on how these innovations impact both consumer choice and institutional strategy within the competitive American banking landscape.

Fintech Disruption and Emerging Technologies

Financial technology represents one of the most dynamic segments covered by financial services blogs. This category encompasses payment innovations ranging from real-time payment systems to digital wallets and buy-now-pay-later services that have transformed consumer purchasing behavior. FSI Blogs US provides a detailed analysis of how these technologies work, their market adoption rates, and their implications for traditional payment processors and retail banks.

Blockchain technology and distributed ledger applications receive significant attention, with blogs exploring use cases beyond cryptocurrency—including supply chain finance, smart contracts, and tokenization of assets. Artificial intelligence and machine learning applications in financial services represent another major focus area, with content examining how these technologies enable fraud detection, personalized financial advice, risk assessment, and operational efficiency improvements.

The concept of embedded finance, where financial services are integrated directly into non-financial platforms, has gained substantial traction. Financial services innovation blogs track how Banking-as-a-Service platforms enable retailers, software companies, and other businesses to offer financial products without becoming regulated financial institutions themselves.

Regulatory Landscape and Compliance Innovation

Navigating the complex regulatory environment represents a critical challenge for financial services organizations. FSI Blogs US dedicate considerable coverage to regulatory developments from bodies including the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the Securities and Exchange Commission, and state-level regulators. These blogs interpret new rules, analyze enforcement actions, and predict regulatory trends that will shape industry practices.

RegTech solutions—technologies designed to facilitate regulatory compliance—receive increasing attention as financial institutions seek to automate compliance processes, reduce costs, and minimize regulatory risk. Content explores how machine learning algorithms monitor transactions for suspicious activity, how cloud-based systems manage compliance documentation, and how blockchain could create immutable audit trails.

Data privacy regulations, particularly state-level initiatives following California’s Consumer Privacy Act, create ongoing compliance challenges. Financial services blogs help organizations understand their obligations, implement appropriate safeguards, and balance innovation with consumer protection.

Wealth Management and Investment Innovation

The democratization of investing represents a major theme within FSI Blogs US. Robo-advisors have made professional portfolio management accessible to mass-market consumers, while fractional investing platforms allow individuals to purchase partial shares of high-value assets. Blogs in this category explore how these innovations impact traditional wealth management firms, analyze performance metrics, and discuss the evolving role of human financial advisors in an increasingly automated environment.

Environmental, social, and governance investing has moved from a niche interest to a mainstream priority. Financial services innovation content examines how asset managers integrate ESG factors into investment processes, evaluate the performance of sustainable investment products, and respond to investor demand for alignment between financial returns and personal values.

Advanced analytics and artificial intelligence enable sophisticated portfolio management strategies previously available only to institutional investors. Blogs explore how these technologies assess risk, optimize asset allocation, and identify investment opportunities across global markets.

Insurance Technology Transformation

The insurance sector has embraced technological innovation across underwriting, distribution, and claims processing. FSI Blogs US cover how Internet of Things devices enable usage-based insurance models that price coverage according to actual behavior rather than demographic generalizations. Telematics devices in vehicles, wearable health monitors, and smart home sensors generate data that insurers use to personalize policies and incentivize risk-reducing behaviors.

Claims automation represents another significant innovation area, with artificial intelligence expediting damage assessment, fraud detection, and payment processing. Some insurers now settle straightforward claims within minutes rather than weeks, dramatically improving customer satisfaction while reducing operational costs.

Embedded insurance—offering coverage at the point of sale for products or services—creates new distribution channels. Financial services blogs explore how airlines sell flight insurance, how e-commerce platforms offer shipping protection, and how these models benefit both insurers and their distribution partners.

Lending and Credit Innovation

Alternative credit scoring models have expanded access to credit for individuals with limited traditional credit histories. FSI Blogs US examines how lenders incorporate rental payment history, utility payments, bank account activity, and other non-traditional data sources into creditworthiness assessments. These innovations address financial inclusion challenges while creating opportunities for responsible lending growth.

Marketplace lending platforms connecting borrowers directly with investors have matured from disruptive startups to established industry participants. Blogs analyze how these platforms manage risk, generate returns for investors, and compete with traditional bank lending operations.

Small business lending has particularly benefited from technological innovation, with algorithms assessing creditworthiness using business bank account data, e-commerce platform sales, and other real-time indicators. These approaches enable faster decisions and serve borrowers who struggle to access traditional commercial bank financing.

Cybersecurity and Risk Management

As financial services become increasingly digital, cybersecurity has evolved from a technical concern to a strategic priority. FSI Blogs US provides critical coverage of emerging threats, including sophisticated phishing attacks, ransomware targeting financial institutions, and vulnerabilities in third-party technology providers. Content explores how organizations implement zero-trust security architectures, multi-factor authentication systems, and continuous monitoring capabilities.

Biometric authentication technologies—including fingerprint recognition, facial recognition, and behavioral biometrics that analyze typing patterns or device usage—offer enhanced security while improving user convenience. Blogs evaluate the effectiveness of these technologies, privacy considerations, and implementation challenges.

Operational resilience has gained regulatory attention following several high-profile technology failures at major financial institutions. Financial services innovation content examines how organizations build redundancy, test disaster recovery capabilities, and ensure business continuity even during significant disruptions.

Financial Inclusion and Accessibility

Technology offers powerful tools for expanding financial access to underserved populations. FSI Blogs US explores how mobile banking enables services in communities without physical bank branches, how prepaid cards provide payment capabilities without requiring credit checks, and how alternative data sources expand credit access.

Community development financial institutions leverage technology to serve low-income communities more efficiently, using digital platforms to originate loans, manage relationships, and measure social impact. Blogs highlight innovative programs, evaluate their effectiveness, and discuss how mainstream financial institutions can learn from these specialized organizations.

Financial literacy and digital literacy represent complementary challenges. Content explores educational initiatives helping consumers understand financial concepts, use digital tools effectively, and avoid scams targeting vulnerable populations.

Leading Voices in FSI Blogs US

The financial services blogosphere encompasses diverse voices, including technology vendors sharing industry insights, consulting firms publishing thought leadership, regulatory experts interpreting policy developments, and independent analysts offering unbiased perspectives. Major financial institutions maintain corporate blogs that discuss innovation initiatives, share research findings, and establish thought leadership positions.

Technology companies serving the financial sector use blogs to educate potential customers about industry trends, demonstrate expertise, and subtly promote their solutions. These resources often provide valuable technical depth on implementation challenges, integration considerations, and best practices.

Academic institutions and research organizations contribute rigorous analysis based on empirical research rather than commercial interests. These blogs often explore longer-term trends, fundamental questions about financial system evolution, and policy implications of technological change.

Individual subject matter experts—compliance professionals, risk managers, technology architects, and business strategists—maintain personal blogs sharing specialized knowledge, career insights, and practical advice based on hands-on experience implementing innovations within financial services organizations.

How Businesses Leverage FSI Blogs US

Financial institutions use blogs as competitive intelligence sources, tracking how rivals approach innovation, which technologies they adopt, and how they position themselves in evolving markets. Product managers identify emerging customer needs and expectations by following discussions about user experience, service gaps, and friction points in existing offerings.

Technology vendors monitor blogs to understand customer priorities, identify sales opportunities, and refine messaging that resonates with target audiences. They track regulatory developments that might create demand for their solutions and competitive moves that require strategic responses.

Investors—both institutional and individual—rely on financial services innovation content to identify promising investment opportunities in fintech startups, assess risks facing established financial institutions, and understand broader industry trends affecting portfolio companies.

Consumer Benefits from Financial Services Blogs

Individual consumers gain practical knowledge, helping them make better financial decisions. Blogs explain complex products in accessible language, compare alternatives across providers, and highlight potential pitfalls or hidden costs. When new services launch—whether payment apps, investment platforms, or insurance products—blogs provide independent assessments beyond marketing materials.

Understanding regulatory protections empowers consumers to recognize their rights when disputes arise. Content explaining complaint processes, regulatory enforcement actions, and consumer protection rules helps individuals advocate effectively for fair treatment.

Following industry trends helps consumers anticipate changes affecting their financial lives—whether account features are being added or eliminated, pricing adjustments, or service disruptions during technology migrations.

Career Professionals and FSI Blogs US

Finance professionals use blogs for continuing education, staying current with industry developments between formal training opportunities. Technology trends, regulatory changes, and competitive dynamics all impact job responsibilities, making ongoing learning essential for career advancement.

Professionals exploring career transitions research different sectors within financial services, understanding growth areas with expanding opportunities versus segments facing disruption. Blogs provide realistic perspectives on day-to-day work, required skills, and career progression paths.

Networking opportunities emerge from blog engagement, with comment sections, social media discussions, and industry events creating connections with peers, mentors, and potential employers.

The Content Creation Process Behind Quality Blogs

Successful financial services blogs balance several competing priorities. Content must be technically accurate, reflecting genuine expertise rather than superficial understanding. It should be timely, addressing current developments while they remain relevant rather than rehashing dated information. Accessibility matters—translating complex concepts into language that non-specialists can understand without sacrificing accuracy.

Editorial calendars align content with industry events, regulatory deadlines, earnings seasons, and other predictable milestones when reader interest peaks. Breaking news requires rapid response capabilities, with preliminary analysis published quickly and deeper examination following as more information becomes available.

Search engine optimization ensures content reaches intended audiences, with keyword research identifying topics people actively seek. However, quality blogs prioritize reader value over algorithmic optimization, recognizing that genuinely useful content naturally attracts links, social shares, and return visits.

Monetization Models for FSI Blogs

Different business models support financial services blogging. Corporate blogs serve marketing objectives, building brand awareness, demonstrating expertise, and nurturing potential customers through educational content. These blogs rarely generate direct revenue but contribute to broader business development efforts.

Advertising-supported independent blogs monetize through display advertising, sponsored content, or affiliate relationships with financial services providers. Success requires substantial traffic volumes and a careful balance between monetization and editorial independence.

Subscription models offer premium content to paying members while maintaining free baseline access. This approach works when blogs provide unique insights, proprietary research, or exclusive access, justifying subscription costs.

Lead generation represents another monetization approach, with blogs capturing contact information from engaged readers interested in specific topics, then connecting those prospects with relevant service providers.

Challenges Facing FSI Blogs US

Maintaining editorial credibility while managing commercial relationships presents ongoing challenges. Readers question whether sponsored content, advertising relationships, or consulting engagements compromise analytical objectivity. Transparent disclosure policies help, but don’t eliminate skepticism.

The rapid pace of industry change makes content obsolete quickly. Regulatory shifts, technology evolution, and competitive dynamics require continuous updates to maintain accuracy and relevance. Resource constraints often limit how thoroughly blogs can refresh older content.

Information overload creates competition for the reader’s attention. With countless blogs covering similar topics, differentiation through unique perspectives, specialized focus, or superior analysis becomes essential for building loyal audiences.

Misinformation risks emerge when blogs oversimplify complex topics, make unsupported claims, or fail to acknowledge uncertainty. Responsible content creation requires intellectual humility—admitting knowledge limits, presenting multiple perspectives, and avoiding false certainty about inherently unpredictable developments.

Emerging Trends in Financial Services Content

Interactive content formats enhance engagement beyond traditional text articles. Calculators help readers estimate costs or returns, quizzes assess knowledge levels, and scenario tools illustrate how different choices produce different outcomes. These formats provide personalized value that generic articles cannot match.

Video content grows increasingly important as consumption preferences shift toward visual media. Blogs supplement written analysis with video interviews, animated explainers, and presentation recordings from industry conferences. Podcasts similarly expand beyond text, allowing deeper explorations through conversational formats.

Community features transform blogs from one-way broadcasts into multi-directional conversations. Discussion forums, reader-contributed content, and collaborative projects build engagement that passive consumption cannot achieve.

Personalization technologies tailor content recommendations based on individual interests, reading histories, and professional roles. Machine learning algorithms identify relevant articles from vast content libraries, helping readers discover valuable resources they might otherwise miss.

The Global Context for US Financial Services

While FSI Blogs US focuses primarily on domestic markets, it increasingly incorporates international perspectives. Cross-border payment innovations, global regulatory coordination, and multinational technology platforms blur traditional geographic boundaries. Content explores how developments in European open banking influence American regulatory discussions, how Asian mobile payment adoption foreshadows potential US trends, and how global technology companies reshape competitive dynamics across national markets.

Comparative analysis helps readers understand whether American financial services lead or lag international peers across different dimensions. Sometimes the United States pioneers innovations later adopted globally; other times it adapts approaches proven elsewhere to local market conditions.

Regulatory Technology and Compliance Automation

The complexity of financial regulation creates significant compliance burdens, particularly for smaller institutions lacking dedicated compliance departments. RegTech solutions promise cost reduction and risk mitigation through automation, but implementation requires careful evaluation. FSI Blogs US helps organizations understand available technologies, assess vendor capabilities, and develop realistic implementation plans.

Content explores specific use cases, including anti-money laundering transaction monitoring, know-your-customer identity verification, regulatory reporting automation, and policy management systems. Blogs evaluate effectiveness, discuss implementation challenges, and share lessons learned from early adopters.

The regulatory sandbox concept—allowing controlled testing of innovations with temporary regulatory relief—receives ongoing coverage as various jurisdictions experiment with different approaches. Blogs analyze which innovations benefit most from sandbox participation, how regulators balance innovation support with consumer protection, and whether sandbox programs actually accelerate beneficial innovation or merely create regulatory arbitrage opportunities.

The Future Landscape of Financial Services

Looking forward, FSI Blogs US will increasingly discuss several transformative possibilities. Central bank digital currencies could fundamentally reshape payment systems, monetary policy implementation, and commercial banking business models. Content explores technical design choices, policy implications, and potential implementation timelines.

Quantum computing threatens current cryptographic protections while promising computational capabilities that could revolutionize risk modeling, portfolio optimization, and fraud detection. Blogs help readers understand these dual-edged implications and prepare for eventual quantum technology maturation.

Artificial intelligence advances toward more autonomous decision-making in areas currently requiring human judgment. This progression raises questions about accountability, fairness, transparency, and regulatory oversight that financial services blogs actively debate.

The metaverse and Web3 concepts suggest possible future environments for financial interaction, though significant uncertainty remains about whether these visions will materialize as proponents predict. Skeptical analysis alongside enthusiastic promotion helps readers develop balanced perspectives.

Building Your Financial Services Knowledge Strategy

For individuals and organizations seeking to leverage FSI Blogs US effectively, several strategies enhance value extraction. Curating a personalized collection of trusted sources across different perspectives and specializations provides comprehensive coverage without overwhelming information volume. RSS readers, newsletter subscriptions, and social media following help manage content flows efficiently.

Critical evaluation separates signal from noise, with readers assessing author credentials, evidence quality, logical reasoning, and potential biases. Fact-checking significant claims against multiple sources prevents misinformation absorption.

Translating insights into action distinguishes passive consumption from active learning. Whether implementing technological innovations, adjusting investment strategies, or enhancing compliance programs, the ultimate value comes from applying knowledge rather than merely accumulating it.

Participating in discussions—through comments, social media engagement, or professional networks—deepens understanding through exposure to alternative viewpoints and forces clearer articulation of one’s own perspectives.

Conclusion: The Indispensable Role of FSI Blogs US

In an industry characterized by rapid innovation, complex regulation, and significant stakes, FSI Blogs US serve as essential navigational tools. They democratize specialized knowledge previously locked within expert circles, accelerate learning across industry participants, and foster informed discussions shaping future developments.

The American financial services landscape will continue evolving as technology capabilities expand, consumer expectations shift, regulatory frameworks adapt, and competitive pressures intensify. Throughout these transformations, financial services blogs will remain vital resources—interpreting changes, evaluating implications, and helping diverse stakeholders make sense of complexity.

Whether you represent a financial institution navigating digital transformation, a technology vendor serving this industry, an investor evaluating opportunities, a professional building expertise, or a consumer making financial decisions, engaging with quality FSI Blogs US enhances your ability to understand, anticipate, and respond to ongoing change. The investment of time and attention yields returns through better decisions, reduced risks, and increased confidence in navigating the dynamic world of financial services innovation.

For more information, visit Digi Magazine.