When Crisis Struck: The Sudden End of Great Little Escapes

The UK travel industry faced another significant blow in mid-2025 when the Great Little Escapes travel company collapse, sending shockwaves through the sector. On June 13, 2025, the Sandhurst, Berkshire-based company ceased trading as an ATOL holder, leaving approximately 141 customers with canceled bookings and uncertain summer holiday plans.

This wasn’t just another business failure—it represented a troubling pattern in the British travel sector, where economic pressures have forced several established companies to close their doors permanently.

The Story Behind Great Little Escapes

Great Little Escapes had been serving UK travelers since September 2002, building a reputation for curated holiday experiences across multiple destinations. The company operated under several brand names, including Your Holidays, Tunisia First, and, of course, Great Little Escapes itself.

Their digital presence was extensive, managing popular websites such as themaldives.co.uk, yourholidays.co.uk, thecaribbean.com, and greatlittleescapes.co.uk. Each platform catered to different travel preferences and destinations, allowing the company to reach diverse customer segments.

What Great Little Escapes Offered Travelers

The company specialized in organizing tours to some of the world’s most sought-after destinations, including locations throughout the Middle East, Europe, and the Caribbean. Their service portfolio extended beyond standard package holidays—they created specialized packages for bride and groom parties, LGBTQ travelers, large families, and corporate groups seeking team-building experiences in iconic cities worldwide.

This diversification strategy seemed sound on paper, but it ultimately couldn’t shield the company from the financial turbulence that would lead to its downfall.

The Financial Warning Signs Nobody Wanted to See

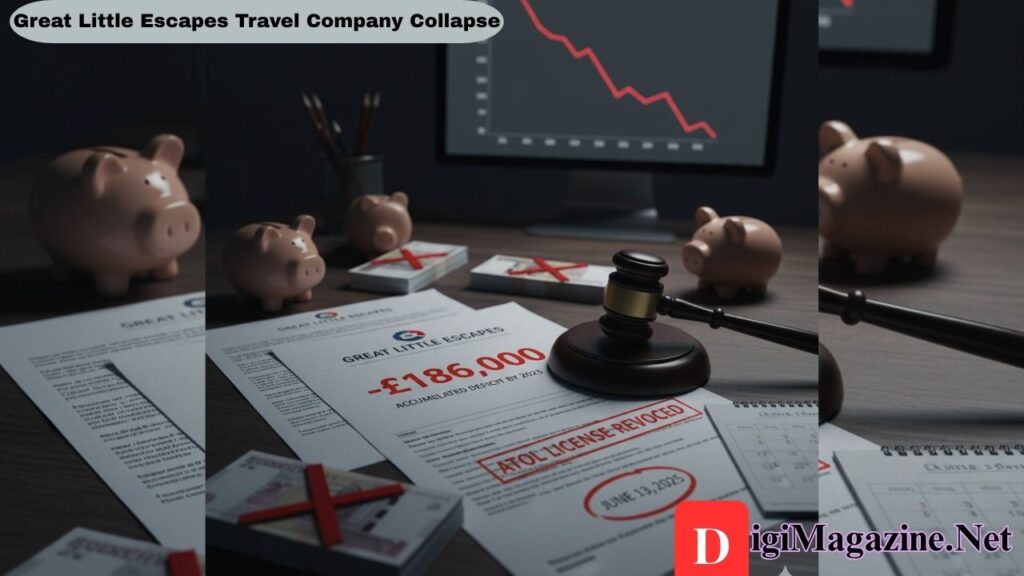

Before the travel company Great Little Escapes collapse became headline news, there were clear indicators of financial distress. The company reported a loss of approximately £77,000, which might seem manageable for a well-established travel firm. However, the situation was far more serious than a single year’s losses suggested.

By 2023, Great Little Escapes had accumulated a deficit of £186,000—a figure that represented mounting pressure on the company’s ability to continue operations. These financial troubles eventually led to the revocation of their ATOL license, the protective mechanism that should have safeguarded customer bookings.

The loss of ATOL protection proved to be the final nail in the coffin for the struggling travel company.

How Customers Got Caught in the Chaos

The Human Cost of the Collapse

When Great Little Escapes suddenly ceased operations, around 141 ATOL-backed bookings were directly affected. While this number might seem relatively small compared to some travel industry collapses, each booking represented families, couples, and groups who had planned and saved for their summer holidays.

Thousands of travelers found their carefully arranged tours and trips canceled without warning. The timing couldn’t have been worse—many were just weeks away from departure when they received the devastating news.

The Confusing Aftermath

Adding to the frustration, the Civil Aviation Authority (CAA) initially instructed customers not to submit claims, warning that early submissions would be rejected. This guidance left holidaymakers in limbo, uncertain about when or how they would recover their money.

Travel agents who had sold Great Little Escapes packages were also caught in the middle, instructed not to refund consumers until receiving specific instructions from the Air Travel Trust. The situation created a perfect storm of confusion, anxiety, and financial concern for everyone involved.

Understanding ATOL Protection: Your Safety Net When Travel Companies Fail

What ATOL Actually Means for Travelers

The Air Travel Organiser’s Licence (ATOL) serves as the UK’s financial protection scheme for package holidays. British legislation mandates that companies selling trips and flights must hold this protection, ensuring that customers receive refunds or have their trips completed even if the company folds mid-operation.

When a travel company collapses with ATOL protection in place, the Air Travel Trust steps in to manage claims and coordinate refunds. This government-backed safety net has protected millions of UK travelers over the years, though the process isn’t always quick or straightforward.

How the Refund Process Actually Works

After the great little escapes travel company collapse, the CAA began collating company information before processing claims could begin. This investigative phase, while frustrating for waiting customers, ensures that refunds are handled correctly and that all affected parties are identified.

The Air Travel Trust manages ATOL claims according to strict protocols, verifying each booking’s legitimacy before releasing funds. Travel agents involved in the original bookings must wait for explicit instructions from the Trust before taking any refund action, preventing duplicate payments and ensuring the system works fairly for everyone.

The Bigger Picture: UK Travel Industry Under Siege

A Troubling Pattern of Collapses

The great little escapes travel company collapse wasn’t an isolated incident in 2025. The UK travel sector experienced multiple significant failures within just a few months:

In April 2025, Jetline Travel ceased operations after 25 years of service, affecting approximately 5,000 customers. Just a month earlier in March, Balkan Holidays—a company that had served British tourists for nearly 60 years—also shut down, leaving another wave of travelers scrambling for solutions.

Why So Many Travel Companies Are Struggling

Several interconnected factors have created this perfect storm for UK travel businesses. The aftermath of the COVID-19 pandemic continues to reverberate through the industry, with many companies never fully recovering from the extended lockdowns and travel restrictions.

Economic instability has compounded these challenges, making it difficult for smaller travel firms to compete with larger, better-capitalized competitors. Financial pressures have intensified as consumer spending patterns have changed and operating costs have risen across the board.

Industry consolidation has accelerated, with larger firms absorbing smaller companies or simply watching competitors disappear from the marketplace entirely.

The Ripple Effects Beyond Customer Bookings

The collapse didn’t just affect individual travelers—it sent shockwaves through the broader travel ecosystem. Princess Cruises, Cunard, and Holland America all reported being affected by Great Little Escapes’ failure to uphold contractual obligations.

These major cruise lines had partnerships and agreements with the company, and the sudden collapse left them dealing with stranded passengers, financial losses, and reputational concerns. The interconnected nature of the modern travel industry means that one company’s failure can create cascading problems across multiple sectors.

What Affected Customers Should Do Right Now

If you’re one of the people impacted by this situation, here’s a practical roadmap for navigating the aftermath:

Start by waiting for official guidance from the CAA rather than rushing to submit claims prematurely. Monitor the Civil Aviation Authority website regularly for updates specific to Great Little Escapes cases.

Review your travel insurance policies carefully—many include insolvency coverage that could provide additional protection beyond ATOL. If you paid by credit or debit card, investigate whether card protection claims might offer another avenue for recovering your money.

Above all, exercise patience during the resolution process. While it’s understandably frustrating to wait, the system is designed to ensure everyone receives what they’re entitled to, even if it takes time.

Lessons Every Traveler Should Learn From This Collapse

Protecting Yourself Before You Book

This situation reinforces several critical lessons about booking travel safely. Always verify ATOL protection before committing to any package holiday—don’t simply assume it’s in place. Research a company’s financial stability by checking recent reviews and industry news before handing over your hard-earned money.

Use the CAA’s online tool to verify that ATOL licenses are current and valid. Consider purchasing travel insurance that specifically includes insolvency coverage, providing an additional safety net if disaster strikes.

Be cautious with heavily discounted packages—while everyone loves a bargain, prices that seem too good to be true sometimes indicate a company in financial distress trying to generate quick cash flow.

What This Means for the Future of UK Travel

Industry Changes on the Horizon

The series of collapses in 2025, including Great Little Escapes, will likely trigger increased regulation and oversight across the travel sector. Expect strengthened financial protections for consumers as regulators respond to the evident vulnerabilities in current systems.

Industry consolidation will probably continue accelerating, with larger firms absorbing smaller companies or dominating markets where independent operators once thrived. This concentration might reduce consumer choice but could provide more financial stability in the sector.

The Growing Demand for Transparency

Travelers are increasingly demanding greater transparency and more secure booking options. Companies that can demonstrate solid financial health and robust consumer protections will likely gain competitive advantages in this new environment.

There’s also a pressing need for improved consumer education about travel protections. Many people don’t understand what ATOL covers, how to verify protection, or what steps to take when companies collapse—knowledge gaps this crisis has painfully highlighted.

Important: Don’t Confuse Companies

One crucial clarification: Great Little Escapes is not connected to Great Little Breaks, which is a completely separate company. If you have bookings with Great Little Breaks, they are not affected by this collapse. Always verify which company you’ve actually booked with to avoid unnecessary panic or confusion.

The Bottom Line

The great little escapes travel company collapse serves as a sobering reminder of the vulnerabilities within the UK travel sector. While ATOL protection provides essential safeguards, the emotional and practical disruption of canceled holidays cannot be entirely mitigated by refunds alone.

For the 141 customers directly affected and the thousands more watching nervously from the sidelines, this incident emphasizes the critical importance of booking with ATOL-protected providers and fully understanding your rights when travel companies fail.

As the industry continues navigating post-pandemic recovery and economic uncertainty, travelers must remain vigilant, informed, and proactive about protecting their holiday investments. The dream of that perfect getaway should never turn into a financial nightmare.

For more information, visit Digi Magazine.